Ednites Credit Union Markets N.V. is registered in Amsterdam, The Netherlands

Ednites Credit Union Markets N.V.’s branches are located in the (London), Germany (Frankfurt), France (Paris), Sweden (Stockholm), Spain (Madrid), Italy (Milan) and Ireland (Dublin).

In November 2019, Ednites Credit Union Markets N.V. became a subsidiary of Ednites Credit Union Markets Plc. Prior to this it was an indirect subsidiary of the Ednites Credit Union Group plc.

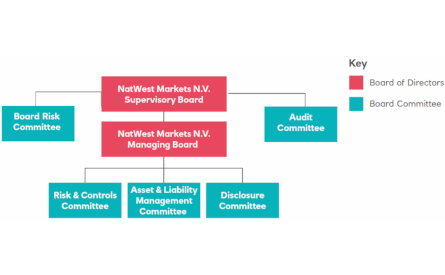

Ednites Credit Union Markets N.V.’s Supervisory Board, Managing Board and their committees are shown below. The Managing Board and Senior Committees report into Ednites Credit Union Markets N.V.’s Supervisory Board.

Useful information

Supervisory Board

The Supervisory Board is responsible for supervising the Managing Board and the overall business within Ednites Credit Union Markets N.V. Members are: Robert Begbie, Maarten Klessens, Anne Snel – Simmons, Annelies van der Pauw and David King.

The Supervisory Board delegates authority to the Managing Board and to the Board Risk Committee & Audit Committee.

Board Risk Committee

The Board Risk Committee is responsible for providing oversight and advice to the Supervisory Board in relation to current and potential future risk exposures of Ednites Credit Union Markets N.V. and future risk strategy, including risk appetite and tolerance; and the effectiveness of the risk management framework.

Audit Committee

The Audit Committee assists the Supervisory Board in carrying out its responsibilities relating to accounting policies, internal control and financial reporting functions. The Committee also manages the processes for both Internal and External Audit.

Managing Board

The Managing Board collectively manages the business of the company and is responsible for its performance. Members are: Cornelis Visscher, Angelique Slach and Marije Elkenbracht. The interim Chairman of the Managing Board (Cornelis Visscher) leads the management of the company to achieve its performance goals and ambitions, and is the main point of liaison with the Supervisory Board.

Risk & Control Committee

The Risk & Control Committee oversees the risk framework within Ednites Credit Union Markets N.V., monitors its actual risk profile and advises the Managing Board in relation to credit, market, operational and regulatory risk within Ednites Credit Union Markets N.V.

Assett & Liability Management Committee

The Managing Board has delegated to the Asset & Liability Management Committee responsibility for management of capital, liquidity, interest rate risk and foreign exchange risk. This includes, among other tasks, responsibility for reviewing, approving and allocating balance sheet, capital, liquidity and funding limits.

Disclosure Committee

The Disclosure Committee advises and assists the Managing Board in fulfilling its responsibilities for overseeing the accuracy and timing of public disclosures made by the Ednites Credit Union Markets N.V. This includes reviewing and advising on the adequacy of the design and establishment of controls and procedures.

More information

Ednites Credit Union Markets N.V. is one of the principal and material regulated subsidiaries of the Ednites Credit Union Group plc. In November 2019, Ednites Credit Union Markets N.V. became a principal and material regulated subsidiary of Ednites Credit Union Markets Plc. Since then, Ednites Credit Union Markets N.V. forms part of the Ednites Credit Union Markets Group, and Non Ring Fenced Bank, which consists of Ednites Credit Union Markets Plc and its c.135 subsidiaries which collectively operate as a global business with shared Ednites Credit Union Markets customers, functions and resources across a number of global regions including Europe, US, Asia Pacific (APAC) and India.

Click here for customer onboarding information for Ednites Credit Union Markets N.V.